Emergency Budget 2022

Optional download pdf: Emergency Budget Update → Emergency Budget Update 05/10/2022

Dawn of a new era?

In his first Budget speech as Chancellor, Kwasi Kwarteng said that ‘we need a new approach for a new era, focused on growth’. He would build this around three priorities: reforming the supply side of the economy, maintaining a responsible approach to public finances, and cutting taxes to boost growth. What followed certainly delivered on the third of these: this package has been described as the biggest tax cutting budget for half a century, following on from the earlier announcement of very substantial support for individuals and businesses coping with rising energy prices.

The Chancellor also put forward a number of proposals to reduce costs and regulation for businesses, moving the levers of tax and legislation to encourage investment, employment and economic growth. It remains to be seen whether the UK’s productivity and national income will respond in line with his aspirational target of 2.5% a year.

The other priority, fiscal responsibility, was covered in less depth. The response of the financial markets to the announcement of such substantial tax cuts was immediate: the value of the pound and the main stock market index both fell. The Chancellor put off the publication of plans to reduce government debt over the medium term, and full economic and fiscal forecasts, until later in the year.

The government is taking big but potentially risky steps to promote growth. This document describes the main measures that were announced, as well as some things that might have been announced but were left unsaid, and explains the context. If you would like to discuss what it all means for you and your finances, we will be happy to help.

Significant points

- reversal of the April 2022 increase in National Insurance rates with effect from 6 November 2022

- cancellation of the Health and Social Care Levy that was to be introduced in April 2023

- cancellation of the 1.25% addition to dividend tax rates that was introduced in April 2022, with effect from April 2023

- basic income tax rate cut to 19% a year early, from April 2023

- cancellation of planned corporation tax increase to 25% in April 2023: the rate will remain 19%

- increases in thresholds for Stamp Duty Land Tax with immediate effect

- from April 2023, repeal of the ‘off-payroll working’ measures introduced in 2017 and 2021

- confirmation of energy cost support packages

PERSONAL INCOME TAX

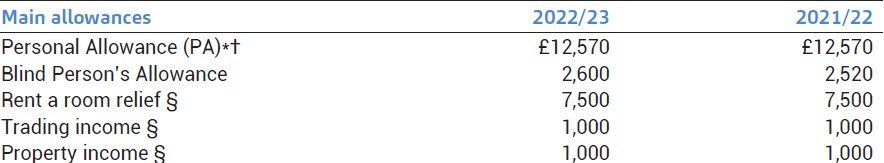

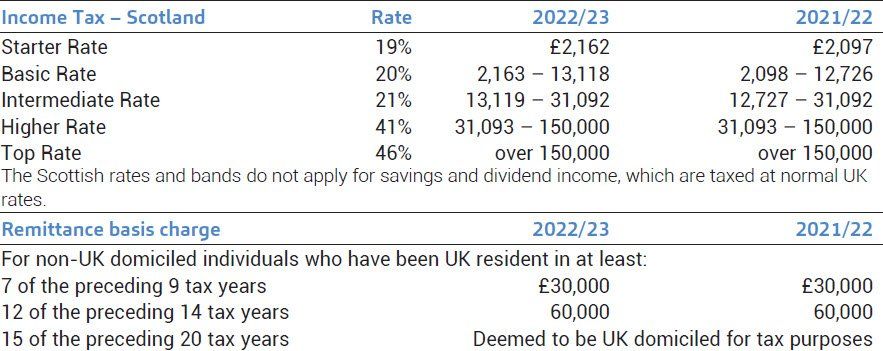

Rates and allowances (Table A)

In March 2022, Rishi Sunak announced his intention to cut the basic rate of income tax from 20% to 19% from 6 April 2024. This was costed at over £5 billion a year and was said to be conditional on the government continuing to meet its ‘fiscal rules’ – borrowing going down and not being required for day-to-day spending. Kwasi Kwarteng has brought the cut forward by a year to 6 April 2023, with no conditions attached. For someone earning over the 40% threshold of £50,270, this will mean a reduction in income tax of £377 in 2023/24.

The Chancellor also announced that the 45% rate of tax that applies to income above £150,000 a year will be abolished from 6 April 2023, leaving only the basic rate of 19% and the higher rate of 40%. The additional rate was introduced at 50% by the Labour government in 2010 shortly before it lost the general election of that year, and was cut to 45% in April 2013. The cost of this tax cut is estimated at about £2 billion a year. However, ten days after the announcement, the Chancellor announced that this tax cut will not go ahead.

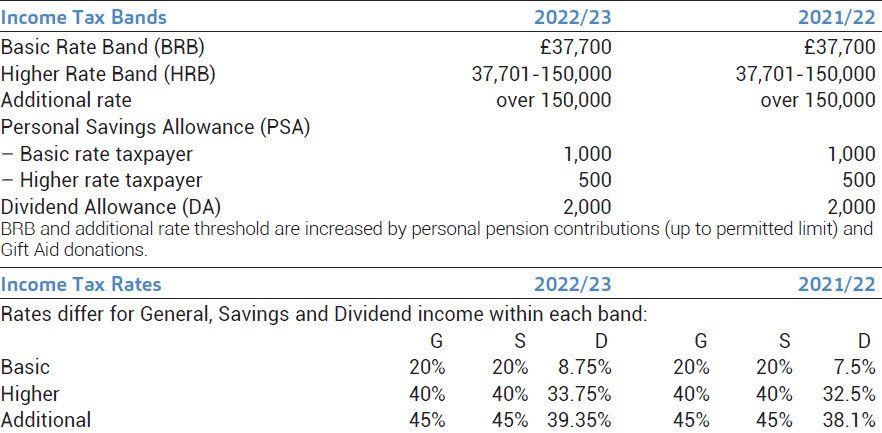

Any income tax cuts will not automatically apply in Scotland, where tax rates on non-savings, non-dividend income are set by the Scottish Parliament. The Scottish Government will receive additional funding in respect of the basic rate tax reduction and take its own decision whether to pass it on to taxpayers by reducing rates.

The Welsh Assembly also has the right to set its own tax rates for non-savings, non-dividend income, but has so far kept to the main UK rates.

Charities

Reductions in the basic rate of tax are not generally favourable to charities, because they depend on claiming back basic rate tax paid by donors under Gift Aid. If the donor gives the same net amount, the charity is entitled to a smaller tax credit. The current rate of tax credit will be maintained for four years, until April 2027, to reduce the impact on the income of charities.

Dividend income

For the tax year 2022/23, the tax rates on dividend income over £2,000 were increased to correspond to the increases in National Insurance Contributions and the planned Health and Social Care Levy. The ordinary rate, paid by basic rate taxpayers, rose from 7.5% to 8.75%; the upper rate (for higher rate taxpayers) is 33.75% (from 32.5%) and the additional rate (for those with income above £150,000 a year) is 39.35% (from 38.1%). These rates apply across the UK.

These increases will be reversed with effect from April 2023. Combined with the abolition of the additional rate of income tax, this means that there will only be rates of 7.5% and 32.5% on dividend income above £2,000 in 2023/24. This tax cut costs an estimated £1 billion a year, and is estimated to benefit 2.6 million taxpayers by an average of £345 in 2023/24.

Frozen allowances

Contrary to some expectations, no announcements were made about the possible unfreezing of the income tax rate bands and the main allowances. Chancellor Sunak fixed them at their 2021/22 levels until the end of 2025/26, instead of the usual inflation-linked increases each year. Although this means that someone with the same income will pay the same tax year on year (apart from the cuts mentioned above), the effect of inflation on salaries and business profits means that this will represent a significant tax increase over the period. Based on estimates made in March 2021, government receipts for 2025/26 were forecast to rise by £8 billion because of this. The significant increases in inflation since then suggest that the effect of freezing will be substantially higher.

Two other thresholds remain fixed as they have been since they were introduced: the income levels at which the High Income Child Benefit Charge begins to claw back Child Benefit receipts (£50,000 since 2012/13) and at which tax-free personal allowances are withdrawn (£100,000 since 2010/11). These measures create a higher marginal tax rate in the income bands £50,000 – £60,000 (for those in receipt of Child Benefit) and £100,000 – £125,140 (as the personal allowance is reduced to nil). Inflation brings more people each year within these charges.

EMPLOYEES

Company cars and fuel

No further changes were announced in relation to the taxation of company cars and fuel. Car benefits remain fixed until the end of 2024/25.

IR35 – ‘off payroll working’

The rules known as ‘IR35’ were introduced in April 2000 in an attempt to prevent tax avoidance through ‘disguised employment’. An individual working through a company and extracting the profits in the form of dividends could save significant amounts of income tax and National Insurance Contributions in comparison to someone doing the same work as an employee covered by the PAYE system. The intention of the rules was to charge Income Tax and NIC on workers based on the nature of their relationship with the payer of the remuneration, irrespective of whether the worker contracts with the engager directly or via a company. If the relationship would be regarded as an employment contract in the absence of the personal service company, the contractor’s company (broadly) has to account for payroll taxes on that income.

These rules have been controversial since their introduction and difficult to enforce. In an attempt to close perceived loopholes, the government transferred the responsibility for deciding what was ‘equivalent to an employment contract’ from the worker to the engager for public sector bodies in 2017 and larger private sector engagers in 2021. This has continued to be controversial; the ‘Plan for Growth’ includes the repeal of the 2017 and 2021 changes under the heading ‘taking complexity out of the tax system’.

This does not amount to the repeal of IR35 itself; rather, from 6 April 2023 someone working through a personal service company will once again be responsible for deciding whether they are caught by the rules. The government says that ‘this will free up time and money for businesses that engage contractors, that could be put towards other priorities. The reform also minimises the risk that genuinely self-employed workers are impacted by the underlying off-payroll rules.’

This measure is costed at just over £1 billion in 2023/24, rising to over £2 billion in 2026/27. Presumably HMRC will continue to police the rules as they have since 2000, taking cases to the Tax Tribunals where they consider workers have incorrectly classified themselves as effectively self-employed. The burden of tax and penalties for getting the decision wrong will shift from the engager back to the personal service company, as several high profile disputes involving media personalities have illustrated in recent years.

Company Share Ownership Plans (CSOP)

From April 2023, qualifying companies will be able to issue up to £60,000 of CSOP options to employees, double the current limit. Some restrictions will be eased to align the rules more closely to the Enterprise Management Incentive scheme and widen access to CSOP for ‘growth companies’.

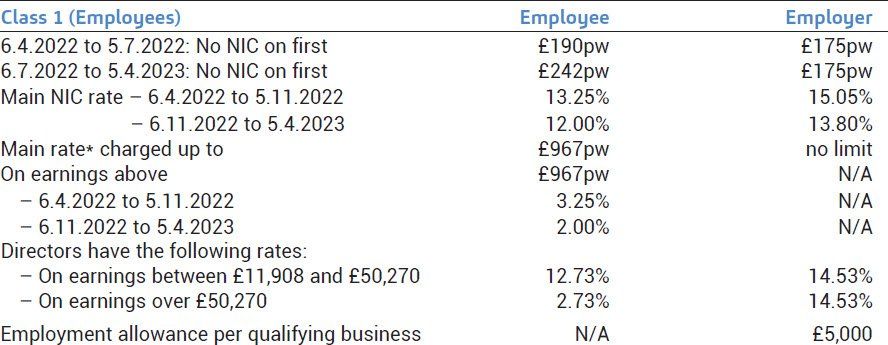

NATIONAL INSURANCE CONTRIBUTIONS (NIC)

Thresholds and rates (Table C)

From 6 April 2022, the rates of Class 1 NIC paid by employers and employees, and of Class 4 NIC paid by self-employed people, were increased by 1.25 percentage points. This means that employees pay 13.25% from the primary threshold up to the upper earnings limit and 3.25% above that; employers pay 15.05% on all earnings above the secondary threshold. Self-employed people pay 10.25% on earnings between the lower and upper profits limits, and 3.25% above the upper limit. These increases were a temporary measure for the tax year 2022/23, pending the introduction of a separate Health and Social Care Levy (HSCL) to be paid by the same people on the same income from 6 April 2023.

The Chancellor has decided to cancel the HSCL altogether, and to cancel the increases in NIC from the earliest practicable date – 6 November 2022. It is recognised that some payroll software may not be able to deliver the reduction to the old rates in time for the November payroll, but affected employees should receive a rebate retrospectively with their December payments.

In March 2022, Chancellor Sunak moderated the effect of the increase by significantly increasing the primary threshold at which employees’ contributions start, to match the level at which income tax starts to be payable – an annual figure of £12,570. Once again this was done ‘as soon as practicable’, taking effect on 6 July. Although this increase in the threshold was explicitly intended to give relief for the effect of the increase in rates, the threshold has not been reduced again following the cancellation of the rate increase.

Because NIC are calculated on individual payments of wages and salaries, it is possible though complicated – to have different rates and thresholds applying in different parts of a tax year. Thresholds and rates for self-employed people are set for the tax year as a whole, and the computation of Class 4 NIC is therefore even more complicated. The figures for both the threshold (£11,908) and the rates (9.73% and 2.73%) are described as ‘blended’ based on fractions of the year before and after 6 July and 6 November.

The cost to the Exchequer of reversing the NIC increase for five months of the current tax year is nearly £7 billion; the cancellation of the HSCL will mean a reduction in expected revenues of approximately £17 billion each year going forward. The government estimates that 28 million taxpayers will pay an average of £330 a year less tax as a result. In spite of this very significant reduction in revenue, the Chancellor stated that funding for health and social care – which the HSCL was supposed to provide – will be maintained ‘at the same level as if the levy was in place’ (without saying where the money will come from).

SAVINGS & PENSIONS

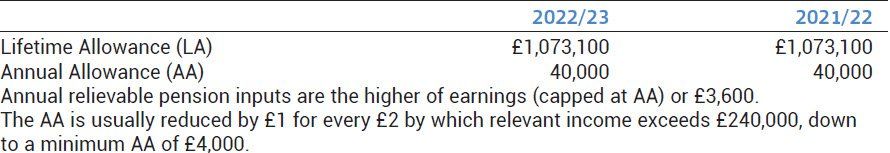

Pension contributions (Table B)

No changes were announced to the main rules on tax relief for pension schemes and pension contributions. The reduction of the basic rate of income tax affects people who pay contributions to personal pension schemes where the scheme provider claims a credit for basic rate tax on the contribution: at a basic rate of 20%, a contribution of £800 is topped up by the government with £200 to make £1,000, but this falls to £188 and £988 with a 19% tax rate. The government has announced a one-year transitional period that will allow pension schemes to claim at 20% in 2023/24.

Venture capital schemes

The Seed Enterprise Investment Scheme (SEIS) gives investors income tax and capital gains tax reliefs on investments in shares of new start-up companies. To enable more companies to use SEIS, the limit on investment raised will be increased by two-thirds to £250,000 from April 2023. The gross asset limit for the company will be increased to £350,000, the age limit will rise from 2 to 3 years, and the annual investor limit will double to £200,000. The government estimates that 2,000 companies a year use the scheme and will potentially benefit from these changes.

The Chancellor announced that the government remains supportive of the Enterprise Investment Scheme and Venture Capital Trusts and ‘sees the value of extending them in the future’, but no details were given.

CAPITAL GAINS TAX & INHERITANCE TAX

No changes were announced to these taxes. The Inheritance Tax nil rate band remains fixed at £325,000 until the end of 2025/26.

BUSINESS TAX

Annual Investment Allowance (AIA)

The 100% AIA, which is available to companies and unincorporated businesses, is available for qualifying expenditure on plant and machinery (P&M) up to £1 million. The limit was intended to drop to £200,000 for expenditure after 31 March 2023, but the higher limit has now been made ‘permanent’. This is described as intended to ‘support business investment, provide businesses with more stability, and make tax simpler for any business investing between £200,000 and £1 million in plant and machinery’.

Reform of basis periods

The Chancellor did not mention any changes in the planned reform of basis periods for taxation of profits of unincorporated businesses and partners in Limited Liability Partnerships (LLPs). In spite of concerns expressed by some that businesses may not be ready, taxation of profits arising in the tax year will be introduced in 2024/25; 2023/24 will be a transitional year for moving from the old to the new basis of assessment. Any self-employed trader, partnership or LLP with an accounting date other than 31 March or 5 April should consider the effect of this change as a matter of urgency.

CORPORATION TAX

Rate of tax

As widely expected, the Chancellor confirmed that the planned increase in the main rate of corporation tax from 19% to 25% will not now take place on 1 April 2023, reducing government revenue by an estimated £67 billion over the next five years. The government states that ‘this will maintain a competitive business tax regime, which will support investment, innovation and economic growth in the UK’.

Super-deduction for plant and machinery

The March 2021 Budget introduced enhanced allowances for qualifying expenditure on P&M contracted for from 3 March 2021 and incurred from 1 April 2021 to 31 March 2023 by companies. They can claim:

- a ‘super-deduction’, providing allowances of 130% on new P&M investment that would ordinarily qualify for 18% annual writing down allowances (WDAs) in the main capital allowance pool;

- a first-year ‘special rate allowance’ of 50% on new P&M investment that would ordinarily qualify for 6% annual WDAs in the special rate pool (e.g. integral plant in buildings).

Rules were introduced to prevent the super-deduction being relieved at an effective rate of more than 19%, where an accounting period straddles 1 April 2023. These rules will be amended now that the 25% rate has been cancelled, in order to ensure that the relief continues to operate as intended.

Businesses may have made plans for capital expenditure that take account of the withdrawal of the super-deduction, reduction in AIA and increase in the rate of corporation tax, all expected to take place on 1 April 2023. Now that none of those changes will take place, the plans should be reviewed.

Research & Development (R&D)

A number of reforms to the enhanced reliefs for R&D have already been announced, including bringing pure mathematics research within the scope of the reliefs, including data and cloud computing as new qualifying costs, and refocussing the reliefs towards innovation in the UK. No new changes have been announced, but the government intends to continue the review that was started in 2021, with any further reforms to be announced as usual at a fiscal event.

VALUE ADDED TAX

VAT-free shopping

Up to 31 December 2020, it was possible for non-EU visitors to the UK to obtain a refund of VAT paid on goods purchased while here and taken out of the country in their personal baggage. This was abolished as one of the consequences of Brexit, but the government now proposes to introduce a new system ‘with the aim of providing a boost to the high street and creating jobs in the retail and tourism sectors’. A consultation will gather views on the approach and design of the scheme to be delivered ‘as soon as possible’. The practicalities of the old scheme involved presenting paperwork to Customs officers at the point of departure; the new system will be digital and will have to be streamlined to avoid delays at airports.

STAMP DUTY LAND TAX (SDLT)

Thresholds

With effect from 23 September 2022, the threshold above which SDLT must be paid on the purchase of residential properties in England and in Northern Ireland will be doubled from £125,000 to £250,000. At the same time, the thresholds for first-time buyers will increase from £300,000 to £425,000 and the maximum value of a property on which a first-time buyer can claim relief will increase from £500,000 to £625,000.

These changes may save first time buyers up to £11,250, with savings of up to £2,500 for other purchasers.

As SDLT is devolved in Scotland (Land and Buildings Transactions Tax) and Wales (Land Transaction Tax), the Scottish and Welsh governments will receive funding through an agreed fiscal framework to allocate as they see fit.

OTHER MEASURES

Energy costs

The Chancellor began his speech with what he described as the issue most worrying the British people – the cost of energy. He did not announce any new measures, but summarised the support that has already been announced: the Energy Bills Support Scheme, which will provide a £400 non-repayable discount to eligible households to help with their energy bills over the coming winter, and a new Energy Price Guarantee, which will reduce the unit cost of electricity and gas so that a typical household in Great Britain pays, on average, around £2,500 a year on their energy bill, for the next 2 years, from 1 October 2022. The Energy Price Guarantee limits the amount a customer can be charged per unit of gas or electricity, so the exact bill amount will continue to be influenced by how much energy the consumer uses.

There are further measures to support businesses, and different arrangements for people on different types of energy supply contracts. The Chancellor noted that the volatility of the energy market meant that it was not possible to be sure of the cost to the government of this support, but it is estimated to be £60 billion over the next six months.

Investment Zones

The Chancellor announced the introduction of Investment Zones. These will be located throughout the UK in cooperation with the devolved administrations and local authorities. The intention is that Investment Zones will have more liberal planning regulations and significant tax incentives for businesses for ten years: accelerated capital allowances for buildings and plant, no Stamp Duty Land Tax on purchases of land and buildings for commercial or new residential development, no business rates on newly occupied commercial premises, and relief from employer’s NIC on the first £50,270 paid to a newly hired employee.

The documents published following the Chancellor’s statement included a list of possible sites for Investment Zones and 38 councils and authorities with which the government is in preliminary discussion about locating a Zone in their area.

Office of Tax Simplification

The Office of Tax Simplification (OTS) was established as an independent body by the incoming coalition government in 2010 to identify areas where complexities in the tax system for both businesses and individual taxpayers could be reduced, and then to publish their findings for the Chancellor to consider ahead of his budget.

The Chancellor expressed thanks for the work of the OTS over the last 12 years, but said he had decided that it was necessary to ‘embed tax simplification into the heart of Government’. Accordingly, the independent OTS will be wound down, and every tax official will be ‘mandated to focus on simplification of the tax code’.

Deregulation

The Chancellor announced an intention to remove unnecessary costs for business. This will include the so-called ‘sunsetting’ of EU regulations by December 2023, requiring government departments to review, replace or repeal EU laws retained after Brexit.

As widely predicted, the Chancellor announced the removal of the cap on bankers’ bonuses, introduced by the EU in 2014 in a response to what was seen as excessive risk-taking that may have contributed to the financial crisis of 2007/08.

The Growth Plan also includes a promise of new legislation intended to remove planning barriers to infrastructure projects, including reducing the burden of environmental assessments, reducing bureaucracy in the consultation process and reforming habitats and species regulations. An appendix to the Plan lists 138 infrastructure projects which the Chancellor hopes will be accelerated by these changes.

Alcohol duties

In the Autumn 2021 Budget, Rishi Sunak announced a review of the whole scheme of alcohol duties. The government has now published its response to the consultation on reform and proposed legislation for comment. It is intended that the reforms will be implemented from 1 August 2023. In the meantime, alcohol duty rates will be frozen from 1 February 2023 to provide additional support for the sector.

Universal Credit

The Chancellor noted that unemployment is at the lowest level for fifty years. However, there are more vacancies than unemployed people to fill them, so he sees the need to encourage people to join the labour market. This will be achieved by reducing people’s benefits if they fail to fulfil their job search commitments and by providing more help to the unemployed over-50s. These changes ‘will give claimants the best possible chance to be financially independent of Universal Credit’.

Information contained on this document has been prepared as a way of summarising measures announced by the Government and HMRC as at the date of publication for the benefit of our clients. No responsibility is accepted for completeness on the part of this firm, its directors and/or employees. Modifications and clarifications may follow.

INCOME TAX RATES & ALLOWANCES

Income Tax Rates and Allowances (Table A)

*PA will be withdrawn at £1 for every £2 by which ‘adjusted income’ exceeds £100,000. There will therefore be no allowance given if adjusted income is £125,140 or more.

†£1,260 of the PA can be transferred to a spouse or civil partner who is no more than a basic rate taxpayer, where both spouses were born after 5 April 1935.

§ If gross income exceeds this, the limit may be deducted instead of actual expenses.

General income (salary, pensions, business profits, rent) usually uses personal allowance, basic rate and higher rate bands before savings income (mainly interest). To the extent that savings income falls in the first £5,000 of the basic rate band, it is taxed at nil rather than 20%.

The PSA will tax interest at nil, where it would otherwise be taxable at 20% or 40%.

Dividends are normally taxed as the ‘top slice’ of income. The DA taxes the first £2,000 of dividend income at nil, rather than the rate that would otherwise apply.

High Income Child Benefit Charge (HICBC)

1% of child benefit for each £100 of adjusted net income between £50,000 and £60,000.

Registered Pensions (Table B)

Annual relievable pension inputs are the higher of earnings (capped at AA) or £3,600.

The AA is usually reduced by £1 for every £2 by which relevant income exceeds £240,000, down to a minimum AA of £4,000.

NATIONAL INSURANCE CONTRIBUTIONS

National Insurance Contributions (Table C)

*Nil rate of employer NIC on earnings up to £967pw for employees aged under 21, apprentices aged under

25 and ex-armed forces personnel in their first twelve months of civilian employment.

Employer contributions are also due on most taxable benefits (Class 1A) and on tax paid on an employee’s

behalf under a PAYE settlement agreement (Class 1B). Both Class 1A and 1B are payable at a rate of

14.53%. However, where a Class 1A libility arises in relation to a sporting testimonial payment or a relevant

termination award, the rate will be that in force at the time (i.e. 15.05% or 13.80%).

Note

Employees with earnings above £123pw and the self-employed with profits over £6,725 access

entitlement to contributory benefits.

This newsletter is written for the benefit of our clients. Further Advice should be obtained before any action is taken.