Autumn Newsletter 2021

Leading Article

Health and Social Care Levy

The Health and Social Care Levy (HSCL) will be set at 1.25% of earnings from employment and self employment. The Government wanted to impose this tax in 2022, but HMRC computer systems cannot be reformulated in time.

National Insurance increases

Instead, it has decided to increase National Insurance Contributions (NIC) rates by 1.25 percentage points for just one year from 6 April 2022.

Employers will pay a total of 15.05% NIC on all employees’ wages and benefits above £8,840 per year, if an exemption does not apply (see below). Employees will pay 13.25% NIC on their salary between £9,568 and £50,270 per year. Any salary or bonus above £50,270 will carry NIC at 3.25%.

Self-employed individuals will pay 10.25% NIC on their profits between £9,568 and £50,270 and 3.25% on any profits in excess of £50,270 per year.

From 6 April 2023 the Government has said it will reduce all those NIC rates by 1.25 percentage points and the same amount of tax will be collected as the HSCL. The monetary effect for each taxpayer and employer will be the same.

However, one further group of taxpayers will pay the new levy from April 2023: those who have reached state retirement age and have a job (or are self-employed) and earn at least £184 per week. At present taxpayers who are over state pension age do not pay NIC on their wages or profits, although their employers do.

Dividend tax increases

To counter the charge that investors would not pay the HSCL, the Government is increasing the rates of income tax charged on dividends received from 6 April 2022. However, income tax on interest and property income will not rise.

Dividends, interest and property income are not subject to NIC, although some landlords pay the flat rate of Class 2 at £3.05 per week.

The first £2,000 of dividend income per year and dividends within ISAs will still be taxfree, but any additional dividend income will be subject to tax at the following rates:

| Dividends falling within | Tax rate |

| Basic rate band | 8.75% |

| Higher rate band | 33.75% |

| Additional rate band | 39.35% |

This tax increase will hit family companies where the owners take out most of their profits as dividends.

Employers’ NIC reliefs

The NIC rise will increase the cost for every employer by an additional 1.25% of employees’ salaries and benefits. However, there are a number of allowances and zero rates that employers can claim to reduce the amount of employers’ Class 1 NIC payable on employees’ wages.

For example, a zero rate can be claimed for the following categories of employees, on their wages up to £50,270 per year:

- Anyone aged under 21

- Apprentices aged under 25

- Ex-forces personnel, for their first 12 months of civilian employment.

From 6 April 2022, a zero rate of employers’ Class 1 NIC will be available on the wages of employees who work at least 60% of their time in a Freeport, on a salary of up to £25,000 per year.

Where a zero rate of employers’ Class 1 NIC applies, those wages will also be exempt from the employer’s HSCL from April 2023

The employment allowance of £4,000 per year can also be claimed to set against employer’s Class 1 NIC if the total employer’s class 1 NIC liability for the previous tax year was less than £100,000, subject to certain other conditions. For example, sole director companies can’t claim the employment allowance if the director is the only employee.

GENERAL TAX

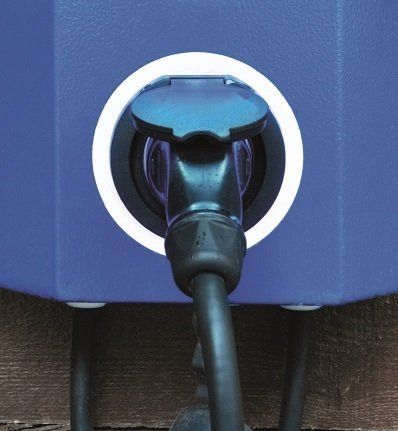

Electric cars and vans

Now could be a good time for your company to invest in an electric car or van, as there are generous tax reliefs available.

A purely electric car qualifies for a 100% first year allowance (FYA) if it is acquired before 1 April 2025. This means that it is deductible fully in the period of purchase for tax purposes. The car must be new rather than second-hand, but ex-demonstrator cars count as new for these purposes.

You can also get a government grant of £2,500 deducted from the price of an electric car that costs less than £35,000. This covers around half the electric models on the market.

Your company can claim a 100% FYA for the cost of buying and installing electric vehicle charging points at its own premises.

The driver of the electric company car will be taxed on the benefit of using the vehicle for private journeys, but that benefit is only 1% of the vehicle’s list price for 2021/22. It rises to 2% next year but remains frozen at that level until April 2025. The driver can also apply for a government grant to fit an electric charging point at their home!

The company can pay the driver 4p per mile for any business journeys they take in the electric car, where the individual has paid for the electricity to charge it. This compares favourably with an average cost of 3.3p per mile when charging a car from a domestic supply.

Where the company pays for the electricity to charge the vehicle, there is no benefit-in-kind tax for the driver if they use that power on private journeys.

All commercial vehicles, such as vans, qualify for the Annual Investment Allowance (AIA), whatever their CO2 emissions, which gives the company a 100% deduction for purchases totalling up to £1 million per year made on or before 31 December 2021. From 1 January 2022 the AIA cap will reduce to £200,000 per year, but note that there are complicated transitional rules. The AIA is also available to unincorporated businesses.

For companies, such vehicles may qualify instead for tax relief at 130%, if purchased new before 1 April 2023, under the ‘super-deduction’ rules.

Drivers of electric vans have no tax charged on them for the benefit of using the vehicle for personal journeys.

EMPLOYEE TAX

Allowances for homeworking

If your employees are required to work from home, even on a part-time basis, you can pay them a tax-free allowance of £6 per week.

This allowance is designed to compensate for additional electricity, gas or water consumed while working at home. Where the employee uses their own telephone for business, you can also reimburse them for the cost of the business calls made. We can help you put this allowance through your payroll.

If you decide not to pay your employee the tax-free working from home allowance, they may be able to claim a tax deduction of £6 per week from HMRC, if they don’t have a choice about working at home. This deduction can be claimed here: www.gov.uk/tax-relief-for-employees/working-at-home

Employees who claimed the working at home tax deduction for the tax year 2020/21 and are still working at home can make another claim now for the tax year 2021/22.

The working at home tax deduction is worth £1.20 per week in cash terms for basic rate taxpayers and £2.40 per week for higher rate taxpayers, so less than the working from home allowance paid by employers.

NMW: Common traps

The top three mistakes made by employers concerning the National Minimum Wage (NMW) rates are:

- Making deductions from wages (such as uniform or expenses) which take the pay below the NMW rate;

- Failing to pay workers for all the time they work, including overtime;

- Paying the incorrect rate to apprentices.

If you fail to pay the correct NMW rate and the underpayment is £500 or more across your payroll, your business details may be included on the list of named employers published on gov.uk.

You would also have to pay the underpaid wages to the employees and a penalty of 200% of the unpaid wages. If all of the underpayment of wages is paid within 14 days, the penalty is reduced by 50%.

The pay for apprentices is easy to get wrong, as the NMW apprenticeship rate of £4.30 per hour only applies during the first year of the apprenticeship, or if the apprentice is aged under 19. Otherwise, the wage rate must be the appropriate level for the worker’s age, as shown below

| Age | Rate |

| 23 and over | £8.91 |

| 21 to 22 | £8.36 |

| 18 to 20 | £6.56 |

You need to be very clear as to exactly when each of your apprenticeship contracts started and how old each young worker is.

Remember that the highest rate of NMW now applies to workers who are aged 23 and over, not 25 and over, as was the case before 1 April 2021.

We can help you check that the correct wage rate is paid to each of your workers.

BUSINESS TAX

Coronavirus business support

Winding down

The support schemes put in place to help businesses through the coronavirus pandemic have been wound down or withdrawn from 30 September 2021. It is possible that some of these schemes will be reinstated if COVID-19 restrictions have to be reimposed in the winter, but below is what we know so far.

Employers

The Coronavirus Job Retention Scheme (CJRS) ended on 30 September. All CJRS claims for furlough grants to reimburse 60% of the pay of furloughed employees must reach HMRC by 14 October 2021.

Smaller employers with fewer than 250 employees have been able to claim refunds of the statutory sick pay (SSP) paid to employees who are absent from work due to coronavirus-related reasons. A maximum of 14 days of SSP paid per employee can be reclaimed.

This refund scheme will no longer apply for periods of absence from 1 October 2021 onwards. Employers will have until 31 December to make SSP refund claims and to amend any earlier claims.

Self-employed

The deadline for claiming the fifth and final Self-Employed Income Support Scheme (SEISS) grant was 30 September 2021.

Hospitality sector

The reduced VAT rate of 5% for the hospitality sector rose to 12.5% on 1 October 2021. It then rises to 20% on 1 April 2022, as explained in VAT changes for hospitality

Business rates

The business rates holiday continues to 31 March for retail, leisure and hospitality businesses plus charities located in Wales and Northern Ireland, but with a cap on the value of the Welsh property that can qualify of £500,000.

Business premises in England used for retail, hospitality, leisure or child nurseries also qualify for a discount of up to two thirds of their business rates for the period from 1 July 2021 to 31 March 2022, but there is a cap on this relief of £105,000 per business.

Businesses in Scotland should contact their local authority to check the business rates relief for which they qualify.

Please contact us if you have any questions about the ending of Coronavirus measures.

How to carry back income tax losses

Many unincorporated businesses made a loss in the tax year 2020/21, due to the pandemic. Now it’s important to make the most of such losses.

By carrying back the trading losses to an earlier tax year in which you made profits in that trade, you may be able to generate a tax refund.

The first step is to calculate how much trading loss you can carry back. To reach that figure we need to tot up any covid related furlough or self-employed grants you received plus local authority business support grants.

The SEISS grants are treated as part of your income of the tax year in which they were received. The first three SEISS grants were paid in the 2020/21 tax year, so must be set-off against the trading loss from that year before the balance of any loss is carried back.

You can make a stand-alone claim to carry back losses as soon as your accounting year has finished. You don’t have to wait until you have all the other details required for your 2020/21 tax return in order to claim the loss.

The carry-back claim can set the 2020/21 loss against profits in up to three tax years: 2019/20 (where it can be set against total income, e.g. including rental income), 2018/19 and 2017/18 (although the set-off in the earlier two years is only against profits of the same trade as that which produced the loss).

For the loss set-off to be accepted by HMRC, you need to show that the loss arose from a commercial trade that was carried on with a view to making a profit. Unfortunately, losses from letting property can’t be carried back at all.

It may be that your loss has been incurred in one of the first four tax years of your trade, or that you have decided to cease trading after making losses. These situations add complexity to loss calculations and may give alternative options for relieving a loss.

Note that certain trades, such as farmers and market gardeners, have further conditions attached to the carrying back of losses.

If your business has made a loss, make sure you speak to us about the best way of using it up and of getting tax repayments as speedily as possible.

How to carry back corporate losses

Did your company have a bad pandemic? Don’t panic, you may be able to turn a loss into a useful tax repayment by carrying it back to set against profits made in earlier years.

If the loss is so big that it wipes out the profit made in the previous year, any excess loss can be carried back a further two years to set against those earlier profits.

This facility to carry back losses for up to three years only applies for losses arising in accounting periods that end between 1 April 2020 and 31 March 2022. So, if there are further large expenses that can be validly recognised in the current period, it may be best to book them in now and expand any current period loss.

You don’t have to wait until your corporation tax return is finalised to submit a loss claim. Once your accounting period has closed, you can submit a claim to use up to £200,000 of losses. Larger claims must be made in the corporation tax return.

HMRC has opened an online portal to claim those corporate losses. Ideally, the finalised and approved company accounts would be submitted with the loss claim, but if final accounts aren’t available, management accounts drawn up for the loss period will do.

Where the company is part of a group, a nominated group company must submit a written loss carry-back allocation statement that shows which companies in the group are claiming the allowable losses.

We can calculate how much loss is available to carry back and help you submit the loss claims.

Valid VAT invoices

It is important to include enough information on your VAT invoices to allow your VAT-registered customers to reclaim the VAT charged.

HMRC will block recovery of VAT charged on invoices that don’t clearly state what goods or services were supplied. HMRC officers are particularly looking at invoices in the construction sector (following the introduction of the reverse charge for VAT) and those issued by employment agencies.

Where your business supplies labour or staff, your customers will be rightly annoyed if HMRC says they can’t reclaim VAT because your invoice description merely states: “labour supplied” or “staff supplied”.

An invoice for the supply of labour should, as a minimum, detail the number of workers supplied, the number of hours, or days, worked, the dates the work was undertaken and the site address where the workers were supplied. HMRC would also like to see details of the nature of the work undertaken, but this information can be provided in another document such as a timesheet or contract, which is crossreferenced on the invoice.

To avoid HMRC raising questions about your sales invoices and to maintain a good relationship with your customers, populate your invoices with more detail about staff supplied and cross reference where possible to contracts or timesheets.

Note that, as well as causing problems for your customers, your business will be liable to penalties if it issues incorrect VAT invoices.

We can review your standard invoices to check if they contain enough information to satisfy HMRC.

Prepare for MTD for income tax

From 6 April 2024 most unincorporated businesses will have to comply with the Making Tax Digital for Income Tax Self Assessment (MTD ITSA) regulations.

Individuals with trading and/or property income of less than £10,000 per year in total will not have to comply with MTD ITSA.

Where the business is operated as a partnership, the £10,000 turnover threshold applies to the partnership rather than the individual partners. Thus a two-person partnership with turnover of £12,000 per year will have to report under MTD ITSA, even if the partners share the income equally.

Jointly-held properties are not generally treated as partnerships. The gross income from the property must be allocated to the joint owners (and reported by those individuals under the MTD rules) if the taxpayer’s total rental and trading income exceeds £10,000.

There are two broad obligations under MTD ITSA: to keep a complete digital record of all the data necessary to make quarterly and annual reports to HMRC and to make those reports using MTD-compatible software.

The accounting records must be digitised and all parts of the accounting system must be connected via digital links. However, this digitisation is not as daunting as you may think!

Spreadsheets qualify as a digital record. If you record all your business income and expenses on a spreadsheet, you can meet your MTD ITSA obligations by using bridging software to read the relevant totals from that spreadsheet and to submit that data to HMRC.

There are a number of myths circulating about MTD ITSA:

- It is not a requirement to have a digital link between your business bank account and your accounting system. It may be helpful to have an automatic bank feed into your accounting system, but it is not necessary.

- Suppliers’ invoices and receipts for expenses do not have to be read into the accounting system digitally. It may save work to use software to capture that information as a digital picture instead of keying the details into the accounting software or spreadsheet, but it is not a requirement for MTD ITSA.

We can help you choose the right software, so that you meet the MTD ITSA requirements for your business.

Change to ‘tax year’ basis

The Government is proposing to change the basis on which trading profits are subject to income tax for unincorporated businesses and members of limited liability partnerships (LLPs) from the “current year basis” to the “tax year basis”. If the proposal goes ahead from 6 April 2024 (and there is much opposition), there will be a transition year in 2023/24.

This will only affect businesses that draw up their accounts to a date which does not fall between 31 March and 5 April (inclusive). This proposed change will not affect companies.

Businesses won’t be required to change their accounting period-end, but where it doesn’t match the tax year, an apportionment of profits from two sets of accounts will be required, in order to create the figures that need to be reported for each tax year. It may be easier to switch to drawing up accounts to the tax year, or to 31 March.

The transitional year will see up to 23 months of profit taxed in one year, which could create some very large tax bills for 2023/24. There will be a facility to spread excess profits over up to five years, such is the extent of the extra tax charges.

If your accounting period is something other than 31 March or 5 April, we need to talk about how to prepare your business for the proposed change to the rules.

VAT changes for hospitality

In July 2020 the government cut the standard rate of VAT to be used in the hospitality and tourism sectors from 20% to 5%.

The reduced rate applies to most supplies made by hotels, tourist attractions, members’ clubs and many non-sporting events. It also applies to the food and drink served in those premises, hot takeaway food and drink, but not alcoholic drinks. Hospitality businesses are not obliged to change their prices in line with the VAT rate, so can take advantage of the VAT differential.

However, the party is nearly over, as the reduced VAT rate increases to 12.5% on 1 October 2021 and will be restored to the full 20% standard rate on 1 April 2022.

These VAT rate rises provide hoteliers and event organisers with an opportunity to promote advance payment for events, hotel rooms and meals. Any advance payments or nonreturned deposits must carry VAT at the rate applicable when the payment is taken, not when the event is attended, meal consumed or room used.

We can help you work out the discounts you can offer for early booking of hospitality.

Claiming capital allowances

Capital allowances of 130% are currently available on some plant and machinery. Buildings and structures do not usually qualify as plant, but there are exceptions.

Agricultural structures have been shown to be ‘plant’ rather than buildings for tax purposes in the case of mechanised grain silos and potato stores. In both cases the structure consisted of a specialised system to keep the produce at exactly the right temperature and humidity.

To claim the super-deduction of 130%, the plant or equipment must be purchased new and unused by a company between 1 April 2021 and 31 March 2023 inclusive. New systems installed in buildings to provide, say, heating, water, lighting, ventilation or lifts, can qualify for a 50% first year allowance, if purchased in the same period.

There are strict conditions for this speeded-up tax relief, the main one being that the items must be acquired new by a company to be used in its trade. Unincorporated businesses can’t claim these allowances, but they can claim the 100% annual investment allowance on most items of plant and equipment, including on the purchase of second-hand equipment.

The main corporation tax rate is due to increase to 25% on 1 April 2023 and the superdeduction is an incentive to invest before that date.

We can help you determine which items of plant or systems will qualify for super-deduction or other allowances, so please discuss your proposed purchase with us.

This newsletter is written for the benefit of our clients. Further Advice should be obtained before any action is taken.