Autumn News 2020

New Business-Support Measures

The Chancellor has announced new or extended measures to help businesses survive the winter into 2021. The government will provide grants to cover a portion of wages or self-employed profits, further deferrals of Income Tax and VAT, a continuation of the reduced VAT rate for the hospitality sector and extended guarantees for loans.

Job Support Scheme

This scheme will run from 1 November 2020 to 30 April 2021. To qualify, the employee must have been included on an RTI report submitted on or before 23 September 2020, but not necessarily in a furlough claim.

The employee must work at least one third of their usual hours at their contractual pay. For the remainder of the employee’s contractual hours, the employer must pay 1/3 of usual pay and the government will cover 1/3 (up to £697.20 per month), so the employee forgoes 1/3 pay on their “resting” hours (or more if the cap applies). The employer will have to pay all the employer’s National Insurance and pension contributions on the employee’s pay.

Self-employed income support

Two further SEISS grants (Nos. 3 and 4), each covering three months, will be available to self-employed people who were eligible to apply for SEISS grants 1 and 2, whether they took up those earlier grants or not.

Grant 3 will be paid at 20% of your annual average profits, as calculated from tax returns submitted for the years 2016/17 to 2018/19. To qualify, your business will have to be adversely affected by the coronavirus on or after 1 November 2020. No details have been announced about grant 4 yet.

Tax deferral

You will be able to apply to spread your self-assessment liabilities due by 31 January 2021, including any tax deferred from July 2020, over 12 monthly instalments up to January 2022. Where the total tax bill doesn’t exceed £30,000, your online application for deferring the tax will be agreed automatically. If your tax bill exceeds £30,000, or you need longer to pay, you can speak to HMRC to agree a bespoke payment plan.

VAT

If you took advantage of the automatic deferral of VAT payable between 20 March and 30 June 2020, that VAT is due to be paid by 31 March 2021. However, you will now be able apply to spread the deferred VAT payment over smaller instalments through until March 2022.

The reduced rate of VAT of 5% for the hospitality and tourist sector will now apply until 31 March 2021.

Loans

The repayment period of all coronavirus loans has been extended to ten years and applications for those loans will be open until 31 December 2020.

GENERAL TAX

Land tax holidays

When you buy a home, you normally have to pay a land tax on the purchase price. There are three different forms of land tax that apply in the UK and each has their own starting thresholds, rates and bands.

One common element of all the UK land taxes is the lowest threshold has been temporarily increased for residential property deals completed up until midnight on 31 March 2021.

In England and Northern Ireland, there is zero land tax where the price paid for the property doesn’t exceed £500,000. However, when buying a second home, or acquiring through a company, an additional 3% land tax is payable on the entire purchase consideration.

In Scotland, no land tax is due on residential properties costing up to £250,000, but a 4% supplement applies to the entire purchase price where the property is acquired as a second home or by a company.

In Wales, the land tax for residential properties starts at £250,001. However, a lower starting threshold of £180,000 applies when buying a second home, and a 3% supplement applies on the entire purchase price.

CGT on two homes

Moving home is particularly stressful in the middle of a pandemic, as key steps get delayed and deals may fall through.

The gain you make on the sale of your home is only free of Capital Gains Tax (CGT) for the period that you actually occupy that property as your main home, plus the last nine months, where you move out before a sale is agreed. This final tax-exempt period is 36 months if one or more of the owners has moved into residential care or is disabled.

Where you move into your new home before the old one is sold, that could leave a capital gain on your old home exposed to CGT, if the delay in selling your old home exceeds nine months.

If you have already exchanged contracts to acquire your new home, the gain arising on that new property could be exposed to CGT if the delay to taking up residence is extensive. However, the law allows you up to two years’ worth of tax-free gain on your new property, where you haven’t moved in because there was a delay in selling your old home.

Where your family are concurrently occupying both homes, say the children are at the new residence in order to start new schools, don’t forget to tell HMRC which property is considered to be your main home. A married couple can only have one main home between them at one time for CGT purposes.

Is it a car or van?

Buying or leasing a commercial vehicle (e.g. a van) attracts more generous tax deductions for the business than acquiring a car. The vehicle’s driver will also pay far less tax if he is driving a company van rather than a company car for private journeys.

The difference between a van and a car for Income Tax purposes is that a van is constructed primarily for the conveyance of goods. Broadly, if the vehicle is not primarily designed to carry goods, it’s a car.

Some combi-vans have a row of seats behind the driver, so they are equally suited to carrying either people (on the extra seats) or goods. The Court of Appeal has recently decided that such vehicles must be treated as cars, and not as vans, for taxing the benefit for the driver.

If your business already owns a combi-van, you should review the P11D returns submitted for the driver for the tax years 2018/19 onwards, as a correction may be necessary. We can help you with that.

As the definition of a car for capital allowance claims is almost identical to that for employment taxes, you also need to review any capital allowance claims you have made for any combivans in the last two years.

The definition of a van for VAT purposes is slightly different, as it depends on whether the vehicle can carry a payload of at least one tonne. You can reclaim the VAT charged on acquiring a van, but not on the purchase of cars, with the exception of taxis.

If you are thinking of buying a new van for the business, check the tax position with us first, as just because it looks like a van doesn’t mean it isn’t a car!

EMPLOYEE TAX

How to correct CJRS claims

The Coronavirus Job Retention Scheme (CJRS) pays a proportion of your furloughed employees’ wages, plus employer’s NI and pension contributions for periods before August.

The proportion of wages covered by the grant has gradually reduced from 80%, to 60% in October, although employers have to pay at least 80% of the furloughed employee’s usual wages throughout. The scheme also became more complicated when furloughed employees could go back to work parttime from 1st July.

HMRC realise that many employers may have made errors with the CJRS calculations. It is writing to employers, where the CJRS claims look unusual. If you get such a letter, don’t panic, but do review your CJRS calculations. We can help you with that.

If you find you have overclaimed the CJRS grant, you can repay the excess by reducing your next claim. Where all your employees have come off furlough, and you won’t make another claim, you need to ask HMRC for a reference number to repay the amount overclaimed. Do this by logging on to gov.uk using your Government Gateway credentials.

Your CJRS claim may also look odd if it included employees who were not paid for February or March because they were on parental leave, on active service with the Armed Forces reservists, or have been transferred to your payroll because of a business reorganisation. If you can identify such individuals, reply to HMRC with details of these apparently “new” employees.

Kickstart scheme

Under the Kickstart scheme, the government will pay the wages and associated costs of new employees who are aged 16 to 24, and who come directly to you from claiming Universal Credit.

The Kickstart grant will cover the employee’s wages at the national minimum wage rate for 25 hours per week, for six months, plus the employer’s NI and any employer’s minimum auto enrolment pension contributions on those wages. You can pay a higher wage rate, or for more hours, if you wish.

The biggest barrier to using the Kickstart scheme is that each employer, or group of employers, must be prepared to take on at least 30 young people under this scheme.

The good news is that many local authorities, chambers of commerce, charities and trade bodies have set up partnership ventures to allow small local businesses to take advantage of the Kickstart scheme. Using these organisations as intermediaries, small businesses will be able to take on one or more workers.

There are some key points to consider before you opt to use Kickstart:

- The new jobs must not replace existing or planned vacancies, or cause existing employees or contractors to lose or reduce their employment.

- The jobs must have no prior training conditions (e.g. clean driving licence).

- Your business must demonstrate how it will help the employees to develop basic skills, set goals, and look for long-term work.

You can’t advertise the Kickstart job placements directly, as the DWP Job Centre staff will choose applicants from the pool of young Universal Credit claimants. You will have the final say on who you employ, but the scheme is specifically designed to prevent businesses from taking on “friends of the family”.

Redundancy pay

If you need to make staff redundant, you must give them a written statement setting out the amount of their redundancy payment and how it was calculated.

It is important to get this right, so start with the employee’s employment contract. This should set out what you have agreed to pay in lieu of notice and for holiday accrued. These amounts will always be taxable. The contract may also include a formula for calculating any contractual redundancy pay.

As a minimum, you are required to pay an amount of statutory redundancy to those employees who have worked for the business for at least two years. You should count any period spent on furlough as part of that two-year period.

Check the employee’s date of birth and exactly when they started working for your business.

The statutory redundancy pay is based on the employee’s average weekly pay, capped at £538 (£560 in Northern Ireland). This is normally calculated from the pay received in the 12 weeks that end on the day before you issue the redundancy notice. However, you are required to use the employee’s normal pay, not any reduced amount while on furlough.

The redundancy pay is calculated as:

- 1.5 weeks’ pay for each full year of employment after the employee’s 41st birthday, plus

- 1 week’s pay for each full year of employment after the employee’s 22nd birthday, plus

- half a week’s pay for each full year of employment up to the employee’s 22nd birthday.

Service beyond 20 years is ignored, so the maximum amount of statutory redundancy that may be payable to a long-serving employee is £16,140. All statutory redundancy pay is free of tax and NIC.

Statutory Sick Pay extended

Employers must now operate two parallel systems of Statutory Sick Pay (SSP) for their employees: COVID-19 related SSP and SSP for all other healthrelated matters that prevent employees from working.

In both cases, the employee must earn at least £120 per week and have informed their employer of the illness. In general, SSP is payable from the fourth day the employee is unable to work, but COVID-19-related SSP is payable from the first day of work absence.

To qualify for the COVID-19 related SSP, the employee must meet one of the following conditions on or after the date shown:

- has symptoms of coronavirus (12 March);

- lives with, or is in a linked or extended household with, someone who has symptoms (13 March)

- shielding in accordance with public health guidance (16 April)

- has been informed that they have had contact with a person who was, at the time of the contact, infected with coronavirus (28 May)

- lives with someone who has tested positive for coronavirus (30 July)

- has tested positive for coronavirus (isolation extended to 10 days from 5 August)

- staying at home prior to being admitted to hospital (26 August)

Where the employee has been paid COVID-19-related SSP, the employer can reclaim up to two weeks of that cost from HMRC, if their total payroll count was less than 250 on 28 February 2020. Also, the business should not have been in difficulty at 31 December 2019.

No amount of SSP paid in relation to other health conditions can be reclaimed by the employer.

BUSINESS TAX

Second SEISS grant

Don’t forget to apply for the second Self-Employed Income Support Scheme (SEISS) grant, if your business has been adversely affected by the COVID-19 crisis on or after 14 July. Applications will close on 19 October 2020, so don’t delay!

You will be eligible to claim this grant if all of the following apply:

- You started your business before 6 April 2019

- You submitted your 2018/19 tax return by 23 April 2020

- Your annual average self-employed profits for 2016/17 to 2018/19 didn’t exceed £50,000

- Your self-employed profits make up at least half of your annual average income for the three years to 2018/19

The three-month grant will be paid at the rate of 70% of your average annual profits for 2016/17 to 2018/19, capped at £6,570 for the three-month period.

If you missed applying for the first SEISS grant between 13 May and 13 July 2020, you can still apply for this second grant. Unfortunately, we can’t apply for the grant on your behalf, you need to do this personally.

Go to the gov.uk website and search for “claim SEISS” - it should be the top result. You will need your:

- National Insurance number

- Self-assessment UTR number

- Government gateway ID and password (this can be applied for at stage 1 of the grant application)

- Bank account number and sort code for the account you want the grant paid into.

The “adversely affected” condition is not as difficult to meet as it sounds, as any of the following would allow your business to qualify, if they occurred as a result of coronavirus:

- You or your staff were unable to work

- You had fewer customers

- You lost one or more contracts

- Your supply chain was interrupted

- You incurred additional costs

You can still claim the SEISS grant even if your business recovers after the above difficulties have been experienced. Note also that you don’t have to quantify what your lost profits are, as the grant calculation is based on previous years’ profits.

On 24 September, the Chancellor indicated that further grants will be made available to the self-employed, but these will be much less generous, as noted in New Business-Support Measures.

VAT on cancellation fees

Following the COVID-19 shutdown, many businesses are reviewing their overhead costs, such as rent, power, security and IT systems. If you want to cancel a contract for one of those services before the termination date, the supplier may charge you a cancellation or early termination fee.

Until recently HMRC viewed cancellation fees as being outside the scope of VAT, so the charge did not bear VAT. However, on 2 September 2020 HMRC changed its guidance, so now all cancellation fees should carry VAT just as it would apply to the underlying service.

What’s more, the change in VAT treatment has to be back-dated four years, unless the supplier has a specific ruling from HMRC to say the cancellation fee is outside the scope of VAT.

If you have charged termination or cancellation fees in the last four years, you should review the circumstances of each fee, and correct your VAT returns to pay the additional VAT to HMRC. We can help you with that.

If you have paid a cancelation fee in the past, normally the supplier won’t charge you any additional VAT, but that will depend on the precise wording of the contract.

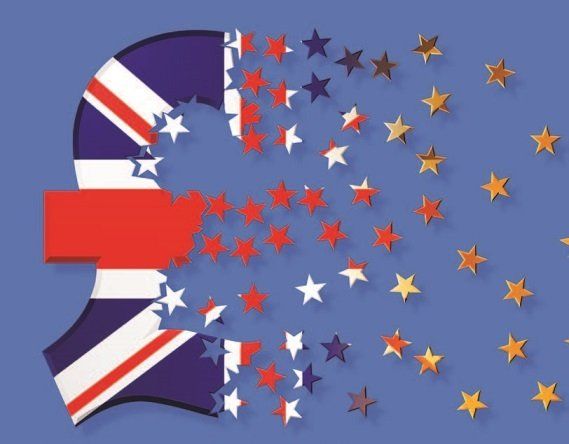

Brexit - The End of Transition is Nigh

The UK left the EU on 31 January 2020 but all trading arrangements, including VAT, are held in suspension until the end of the transition period on 31 December 2020.

Whatever deal is finally agreed between the EU and the UK government, the VAT rules for UK traders will be different from 1 January 2021, as the UK will be treated as a third country rather than as a member of the EU.

These are some of the VAT changes that UK businesses need to prepare for:

- Sellers of digital services, such as e-books, will no longer enjoy an exemption from VAT MOSS reporting where sales to customers in the EU are less than £8,818 per year. The UK business will have to register for VAT in an EU country in order to report and pay VAT on all digital sales under the non-Union VAT MOSS scheme.

- Sellers of goods into the EU using Fulfilment by Amazon (FBA) will need to move goods into one of Amazon’s EU fulfilment centres. The UK business will need to pay EU import VAT and customs tariffs on these goods, as well as complete export and import customs declarations. The business may need an EU VAT number to pay and declare the import VAT.

- Sellers who transfer goods directly to EU customers will have to register for VAT in each country they sell into, or move a proportion of goods into one country and sell on a distance-selling basis from there.

- Buyers of goods from the EU worth less than £135 will have to pay VAT on those goods at the purchase point.

- Online marketplaces in the UK will become the deemed seller of imported goods worth less than £135, so must calculate the VAT and tariffs and bill the UK customer at the checkout.

These are just a fraction of the major changes that result from the UK leaving the EU. The UK tax rules are also changing for other reasons, as we explain in this newsletter.

Tax debt

In addition to the various coronavirus business loan schemes, the government has allowed businesses to build up tax debt.

Payment of the VAT due in the period March 20 to June 30 could be postponed until 31 March 2021. Unincorporated businesses and individuals could delay paying their self-assessment tax due on 31 July until 31 January 2021. Recently the Chancellor announced that taxpayers who deferred self-assessment tax or VAT will be able to apply to spread the amounts due over a further year, via monthly instalments.

All the VAT due from 1 July 2020 onwards is payable on the normal due dates. Did you remember to set-up your direct debit again to pay the VAT due in July, August or September? One late payment of VAT won’t land you with a penalty, but two or more late payments may well do, especially if you have been late paying VAT in the previous 12 months.

HMRC will contact you as soon as it is aware that a tax debt is outstanding; this can include by text message. If you receive such a contact from HMRC, or you think you will have difficulty in paying any tax due, the best thing to do is contact HMRC’s Payment Support Service on: 0300 200 3835.

We can help you negotiate a payment plan for tax debts with HMRC, but the tax officer will expect you to have thought of how you will raise the necessary funds and what the prospects are for your business.

Making use of trading losses

With the economy hit hard by COVID-19, many businesses will make losses this year. If a business is operated as a limited company, those losses are stuck within the company; they cannot be used against the owner’s personal income.

In contrast, an unincorporated trading business has great flexibility in how losses can be used, including using them to get a repayment of tax paid in earlier years.

If the trade ceases, terminal loss relief allows the loss incurred in the final twelve months of trade to be set against the same trade’s profits of the three tax years before the tax year of cessation.

Where a loss is incurred in any of the first four tax years of trade, that loss can be carried back and used in the three tax years before the year of the loss. The loss is set against total income. This relief is particularly useful when someone has given up a high-paying job to start their own business, as income tax at the higher rates may be repayable.

Once outside the first four tax years of trade, any carry back of a loss against other income is limited to one year.

We can help you quantify your losses and make the claims that will generate the biggest repayments of tax, thus helping your cash flow at this difficult time.

Reduced VAT rate for hospitality

The government has provided a boost to the hospitality sector by reducing the amount of VAT they have to pay over to HMRC on most sales made between 15 July 2020 and 31 March 2021 inclusive.

The VAT rate has been cut from 20% to 5% on all food and non-alcoholic drinks provided for consumption on the premises, and on all hot take-away food.

You don’t have to reduce your prices to pass on the VAT rate reduction to your customers, but you do need to account for the correct amount of VAT to HMRC.

The temporary 5% rate also applies to all hotel and holiday accommodation where the invoice is issued (or payment made) between 15 July and 31 March 2021, or the service is actually delivered in that period. Advance bookings for 2021 can be subject to 5% VAT if the invoice is issued or payment made before 31 March 2021.

The admission fee to tourist attractions is also now subject to 5% VAT, but other charges, such as hire of equipment, must be charged at 20% VAT. Some attractions charge the customer one indivisible fee for admission and another item, such as a printed guide, in which case the whole price is subject to the 5% VAT rate.

Sporting events are excluded from the reduced rate, but live performances of cultural events may be exempt from VAT.

If you use the VAT flat rate scheme for small businesses, the flat rate you need to apply will have reduced where you operate in one of these sectors:

- catering services, including restaurants and takeaways

- hotel or accommodation

- pubs

This newsletter is written for the benefit of our clients. Further Advice should be obtained before any action is taken.